Section Identifier

Loans

Federal Loan Programs

Federal Loans are low-interest loans for students and parents that help pay for the cost of a student’s education after high school. The lender is the U.S. Department of Education rather than a bank or other financial institution.

Student loan borrowing cannot exceed the cost of attendance, nor may you borrow over the annual and lifetime aggregates that are set for the Federal Loan. The Department of Education assesses an origination fee on each loan upon disbursement. The type of loan you are offered is based upon the results of your FAFSA.

Student DIRECT LOAN PROGRAMS

Federal Subsidized Direct Loan Program

Who is eligible? Matriculated undergraduate students who are at least half-time and demonstrate financial need. Recipients must be eligible for federal aid and cannot have exceeded federal loan limits. First-time borrowers must complete entrance counseling.

The FAFSA is required for application and a signed promissory note is required for disbursement of this Direct Federal Loan.

Federal Unsubsidized Direct Loan Program

Who is eligible? Matriculated undergraduate students who are at least half-time and do not demonstrate financial need or are independent students. Recipients must be eligible for federal aid and cannot have exceeded federal loan limits. Satisfactory academic progress required. First-time borrowers must complete entrance counseling.

The FAFSA is required for application and a signed promissory note is required for disbursement of this Direct Federal Loan.

Direct Parent Plus Loan

Federal Direct Parent PLUS Loan

Federal Direct Parent PLUS Loans are credit-based loans available to parents of dependent undergraduate students who are enrolled in an eligible degree or certificate program on at least a half-time basis (six credit hours/term). Only U.S. citizens and permanent residents are eligible.

To apply for the Federal Direct PLUS Loan:

The U.S. Department of Education requires completion of the FAFSA for any parent applying for a Federal Direct PLUS Loan.

- Go to the student loan website operated by the U.S. Department of Education.

- Your parent will need a FSA ID to apply for the PLUS loan. This is the same FSA ID your parent used to complete and sign the FAFSA. If your parent doesn’t have a FSA ID, a link on the student loan website will help them to create one. They must keep this ID, for it will be used this year and in subsequent years as you continue to apply for financial aid.

- Click on “Parent Borrowers” then click the link to apply for a PLUS loan. Your parent completes the PLUS application including entering the dollar amount they wish to request. Submitting the on-line application will permit a check of the parent’s credit.

- New borrowers must sign a Master Promissory Note which can also be completed at studentaid.gov

- This application should be submitted at least six weeks prior to the start of the term for Direct Parent PLUS Loan funding to be available by the time classes begin.

Private Alternative Loan

Private or Alternative Loans

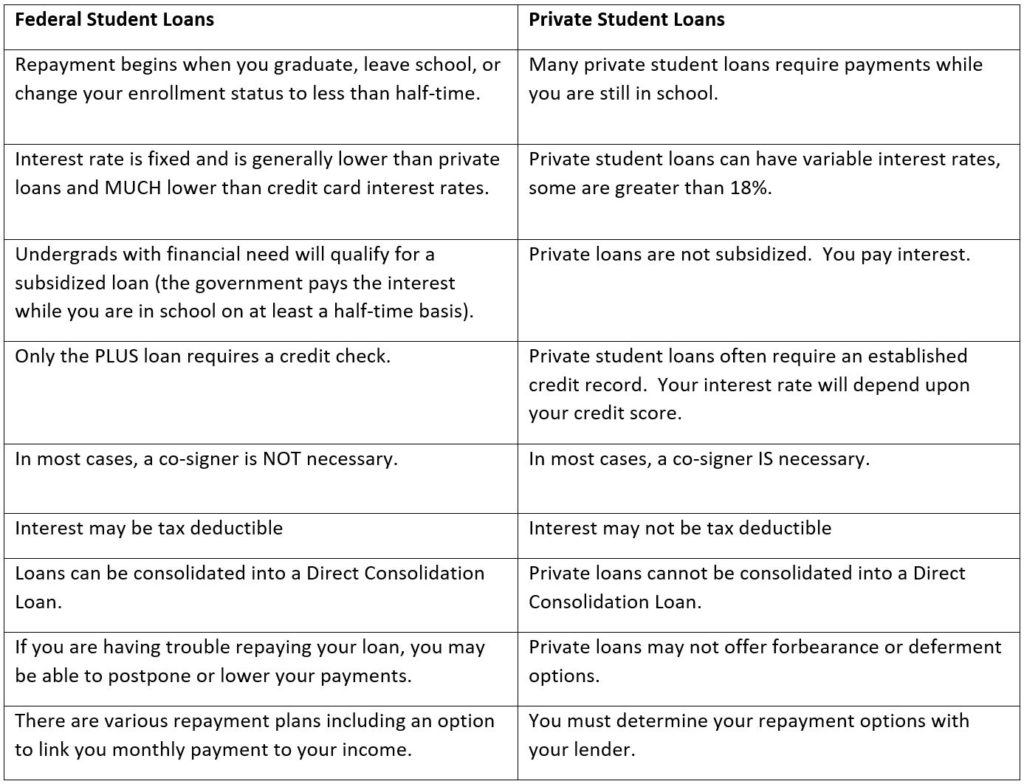

Rather than apply for a Federal PLUS Loan, some families and students choose to apply for private loans to finance their education. Before you make that decision, consider the differences between the federal loan programs and private student loan programs in the table that follows.

A student may choose any lender when borrowing an alternative student loan. It is crucial though that you do your homework and select a lender and a loan that best suits your academic and financial needs as a borrower, since there may be differences in interest rates, fees, credit evaluation, academic progress requirements, repayment terms and borrower benefits. Please visit ElmSelect online lender comparisons to learn more.

It is important to consider all federal loans prior to alternative loans. Please sure to review and compare, especially Alternative loans versus Plus loans. For more information on the differences between federal and private student loans, visit the U.S. Department of Education website.

Interest Rates and Fees

Interest rates vary depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. The table below provides interest rates for Direct Loans first disbursed on or after July 1, 2023.

| Loan Types | Borrower Type | Loans first disbursed on or after 7/1/23 and before 7/1/24 |

| Direct Subsized Loans | Undergraduate | 5.50% |

| Direct Unsubsidized Loans | Undergraduate | 5.50% |

| Direct Unsubsidized Loans | Graduate or Professional | 7.05% |

| Direct PLUS Loans | Parents and Graduate or Professional Studies | 8.05% |

All interest rates shown in the chart above are fixed rates for the life of the loan.

Maximum Annual Direct Loan Amounts

DEPENDENT STUDENTS

| Year in School (by credit earned) | Total Base Sub or Unsubsidized Laon | Additional Unsubsidized Loan | Total Loan |

| 1st (0-27 Credt Hours) | 3,500 | 2,000 | 5,500 |

| 2nd (28-59 Credit Hours) | 4,500 | 2,000 | 6,500 |

| 3rd & 4th (60+ Credit Hours) | 5,500 | 2,000 | 7,500 |

INDEPENDENT STUDENTS

| Year in School (by credit earned) | Total Base Sub or Unsubsidized Laon | Additional Unsubsidized Loan | Total Loan |

| 1st (0-27 Credt Hours) | 3,500 | 6,000 | 9,500 |

| 2nd (28-59 Credit Hours) | 4,500 | 6,000 | 10,500 |

| 3rd & 4th (60+ Credit Hours) | 5,500 | 7,000 | 12,500 |

Total maximum outstanding debt allowable:

$31,000 for dependent undergraduates

$57,500 for independent undergraduates

A dependent student whose parent is denied a Federal Direct Parent Loan may borrow the additional Unsubsidized Direct Loan up to $4,000 for first and second years and $5,000 for third and fourth years.

For more information on federal programs, go to the Federal Student Aid website or call 1-800-4FEDAID.

A sample loan repayment schedule is available at the Federal Student Aid website.

Direct MASTER PROMISSORY NOTE

The Master Promissory Note (MPN) is a federal legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. All federal Direct loan borrowers are required to complete an MPN before they can receive federal loans. Please visit www.studentaid.gov to complete your MPN for the Direct Subsidized/Unsubsidized Loans and Direct Parent PLUS Loans.

Student Direct ENTRANCE AND EXIT COUNSELING

All students taking out Direct Subsidized Loans or Direct Unsubsidized Loans: If you have not previously received a subsidized or unsubsidized loan under the Direct Loan Program or a subsidized or unsubsidized Stafford Loan under the Federal Family Education Loan (FFEL) Program, you’ll be required to complete entrance counseling. Please visit www.studentiaid.gov to complete Entrance Counseling.

Exit counseling provides important information to prepare you to repay your federal student loan(s). If you have received a subsidized, unsubsidized or PLUS loan under the Direct Loan Program loan, you must complete exit counseling each time you: Drop below half-time (less than 6 credits) enrollment, Graduate or Leave school. Please visit www.studentiaid.gov to complete Exit Counseling.

Student Loan Repayment

At Bethany College, we understand that student loans can be intimidating. That’s why we have partnered with Inceptia, a division of the National Student Loan Program, to provide you with free assistance on your student loan obligations to ensure you feel comfortable and can be successful in your loan repayment.

Inceptia may be calling to help you with next steps in your repayment journey. Their friendly counselors are there to help you every step of the way. While you are in your grace period, they might reach out to you to answer questions you may have on your repayment options. If you become delinquent on your loans, they may also contact you to help find a solution that works within your means.

The Inceptia counselors are there to help you with every step by staying in touch with you via phone calls, letters, and/or emails. They will not be collecting money from you. Inceptia’s nonprofit purpose is to help you find answers to your questions and solutions to your issues. We encourage you to visit Inceptia’s Student Loan Knowledge HQ for more information.

You will also want to ensure to understand how to repay your loans. Visit the U.S. Department of Education website for detailed information and options.

If for some reason you find yourself unable to make payments, there are options for you. Click here to learn more.

Info

Visit

Apply

Deposit